Commentators are wondering why the Indian stock market is “shockingly resilient” amidst the devastation caused by the Covid second wave. Their premise is that Covid’s second wave is causing significant devastation and death. 2021 GDP growth has been downgraded. Rising raw material prices will erode margins. The virus has spread across the country and will cause massive unemployment. Analysts have started downgrading estimates. Stock price valuations are 2X of China. So why has the market fallen only 5% since February?

You can read one such piece here

I agree that India is passing through one of the gravest moments in its history. The suffering of our fellow country-men makes me wonder whether this is another 1962 moment in our history.

My disagreement with these commentators is in their belief that stock prices should move in sync with short term economic conditions. That reflects a lack of understanding of both analytical and behavioural issues that affect stock prices.

Analytically, the bulk of value in any decently run company resides in its terminal value. The immediate future (less than 3 years) seldom contributes more than 15% of the value of the firm. Hence, short term earnings disruption should not matter “significantly” from an analytical construct. If FY 22 earnings are impacted – as we expect them to be – over 5 years that should result in some IRR impact. A decline in earnings of say 20% in Yr 1 from earlier estimates, should not impact IRRs by more than 1-2% over 5 years. Hardly reason for stocks to correct significantly.

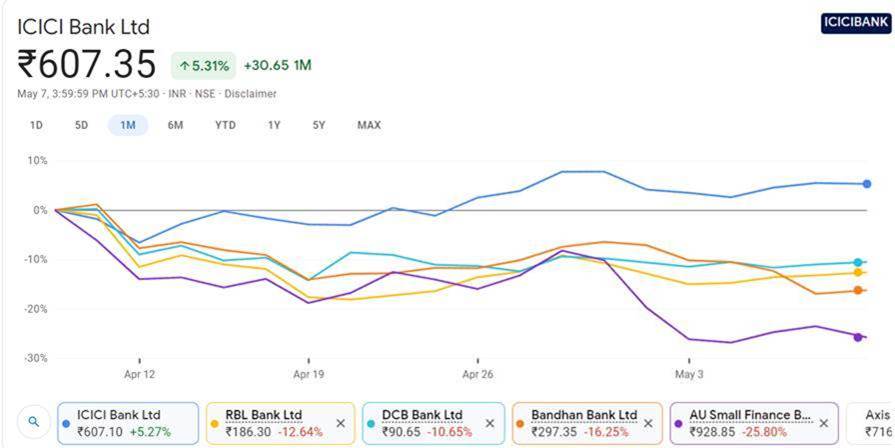

The premise that stock prices are not reflecting the new reality is also not true. Take Banks for instance. The chart below shows that, in the last one month, stock prices of Banks that are serving segments more likely to be impacted (SMEs, Micro Finance etc) have been impacted more than those serving the top of the pyramid. As it should be because these segments will find it very much harder to recover from extended lock downs. Banks serving the top of the pyramid (ICICI/Kotak/HDFC) are well capitalized, did not have significant Asset quality issues in the first wave, are carrying surplus provisions, are cautious on unsecured lending at present and continue to gain market share from weaker players. There is no analytical reason why their stock prices should collapse because of the second wave, unless of course lock downs are extended for long periods of time and the Govt. does not step in with economic relief and feedback loops result in even the highest rated segments getting impacted. That is not the prevailing narrative at present.

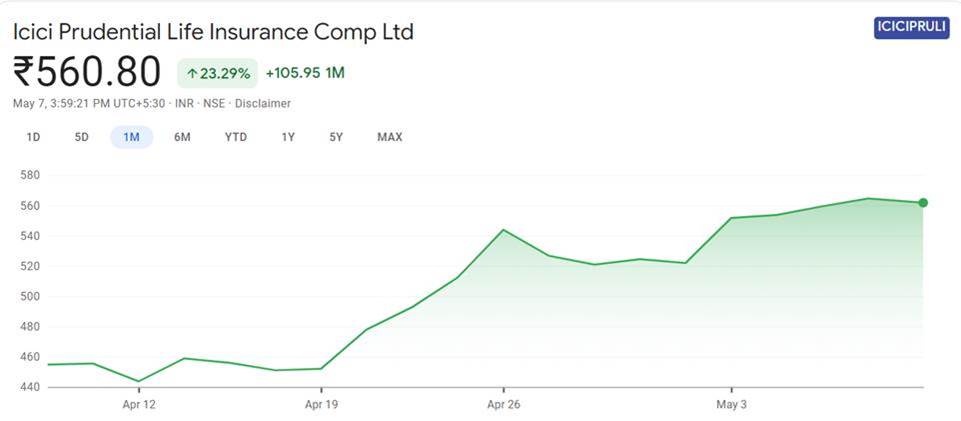

Thirdly, from an analytical perspective, movement of stock prices reflect change in expectations about their prospects embedded in them. Consider ICICI Pru Life. Even as the second Covid wave has resulted in higher number of absolute deaths, the stock price of ICICI Pru Life has moved up ~23% in the last one month. This implies that even as number of absolute claims paid out by ICICI Pru Life may increase, the aggregate impact on ICICI Pru Life will be lower than what analysts were estimating in March based on other variables at play (product mix, operating costs, mortality assumptions vs reality, Covid provisioning). Analysts were too conservative about ICICI Pru Life prospects in March and are updating their views on its prospects, despite being aware of the second wave. The question to ask is what long term assumptions are embedded in prevailing prices

Finally, commentators either do not understand, or choose to disregard behavioural issues that impact stock prices. This is not something that can be modelled.

- Even as FIIs have been selling over the past few weeks, the retail investor in India is becoming more important in share of volume traded. Low rates on Debt instruments means investors are willing to commit more to Equities. Even if we assume current prices may offer a 12% IRR on the Index in Equities over the next 5 years in Indian markets, approx. in line with nominal GDP. That is not very attractive in absolute terms. However, it is very attractive relative to an FD that may yield <4% post-tax .

- And investors who sold in March of last year may not want to make the same mistake again. The first wave of Covid had many unanswered questions – there was ambiguity on death rates, treatment protocols that would work, when vaccines would be available. Most of these questions have answers now. Hence, the uncertainty has shrunk considerably.

We are not offering a view that current stock prices (in aggregate) are justified or that market levels will hold. We don’t know what may happen in the near term. The resilience exhibited by retail investors may break tomorrow because of concerns around Covid or due to some other variable which one is not factoring in at present. Variables that influence short term stock prices can only be understood with the benefit of hindsight. Trying to find an explanation for a multi variate problem reflects poor understanding of the long term investing game.