Technology buzzwords – “ML. AI. Blockchain. Platforms” are fueling investor delusions. We share 2 articles and also explain why we don’t own any “FinTech” as of now.

Technology buzzwords are fueling investor delusions

Zerodha has still not found a use case for AI/ML/Block chain.

“Most of the claims of being powered by AI is superfluous marketing, pure hogwash”

The platform delusion

The promise of a platform business is its magical self-reinforcement. Very few companies are true platforms and most of what we hear are just “buzzwords”.

We believe there is a “Fintech valuation delusion” at play both in Private Markets and in Public Markets.

We don’t believe either Policy Bazaar or PayTM are “platforms” as they do not create a network effect. They are both companies that identified a market need and are run by phenomenal entrepreneurs. However, investing in either at these prices is unlikely to be a happy outcome for minority investors in the long term.

PolicyBazaar

- Is an online Insurance and loans origination broker that will be using its IPO proceeds, among other things to set up a physical distribution channel.

- It is investing for the future and hence it is still not break even. It may be noted that the company was founded in 2008.

- Per a reputed brokerage estimate, PB will break even in FY 26. It is valued today at ~55000 Cr. Policy Bazaar saw a secondary share sale by existing investors in March 2021 at a valuation of ~18000 Cr. So about 8 months ago, smart investors valued the company at ~1/3rd the current MCAP!

- Assuming 10 years down the road PB trades at 30x cash flow, it will need to earn a cash flows of ~8000 Cr by FY31 for one to earn a ~15% annualized return. Assuming 15% PAT margin that would require a revenue of 53000 Cr in FY 31 from <900 Cr revenue in FY 21. That implies about 50x revenue growth in 10 years.

- How would Policy Bazaar be any different from any Financial Services entity that offers an omnichannel experience? What is the Fin Tech play here? What are the odds of such exponential growth?

PayTM

- Core value proposition is payments. The challenge is that payments are free and even if the Govt allowed players to charge, competition would drive the pricing down to zero.

- If PayTM did not exist, we could make payments free of cost thru our bank accounts.

- PayTM believes it can cross-sell other financial products and services to its user base. Cross-sell is an elegant argument, but very difficult to execute in Financial Services. Anyone here bought an Airline ticket through PayTM as yet?

- Per a reputed broker, who has tortured a spreadsheet, PayTM is expected to break even in FY 29.

- PayTM is valued today at 110000 Cr.

- What is the value one should be willing to pay for a business that has no visible path to becoming cash flow positive or has any uniqueness which cannot be found elsewhere?

Let us now compare the above with Axis Bank – traditional Banking play, a position of interest to us

- Axis Bank is valued at 200000 Cr.

- It has regulatory advantages which neither PayTM nor PolicyBazaar have –> ability to raise low cost deposits.

- It is not sitting idle waiting to be disrupted but preparing for disruption by online challengers.

- Its cost of funds are quite close to the sector leaders and the new leadership is grounding its business model on conservativeness, which Banking is all about.

- And it is expected to generate ~18000 Cr PAT in FY 23

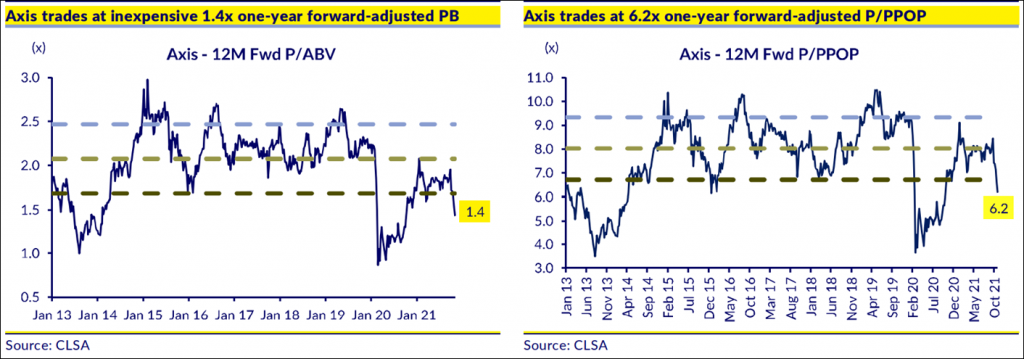

- Valuation close to 5 year low (excluding initial Covid time period).

Which of these business models would you rather own today from the perspective of acceptable return with prudent risktaking?