A salute to our doctors, nurses, police forces and sanitation workers who are at the forefront of this battle. A salute also to the Indian state – we are always criticized by the West, but we show our best when our backs our against the wall. And we have done a far better job than the developed world so far.

I am writing to share a few thoughts

1. Be careful how you interpret the news you are reading

There are multiple opinions around Covid-19. But for every pearl of wisdom out there on the impact of Covid- 19, an opposite insight is equally true. All estimates we have at present – whether on deaths, economic trajectories are all first-order thinking based on assumptions. No one knows anything with certainty.

There are many unanswered questions – how is China returning to normalcy? what percentage of deaths are attributable to pre-existing conditions? at what cumulative infections do we develop immunity as a community? What will be the scale of the stimulus? What medications in trials will work?

The media likes to sensationalize things because pessimism sells. For some strange reason, people like to hear the world is going to go into a basket case.

Here is an article by a Nobel Laureate who is predicting a quick recovery

https://www.latimes.com/science/story/2020-03-22/coronavirus-outbreak-nobel-laureate

2. Financial Advice is always in the context of time horizons

What is right in financial markets in 3-6 month windows could be wrong in 3-5 year windows. You have to align your actions to your time horizons.

I am appending an interview of Aditya Puri which I thought put things in good perspective.

https://twitter.com/CNBCTV18News/status/1241974993988149248?s=19

3. A stimulus is coming

I see many of my peers deeply distressed because of no announcements by the RBI or the FM and attributing that to why markets are falling. Just because India has not announced a stimulus, it does not mean there will not be one. And with Oil at USD30/barrel, inflation under control, we have the ability to stimulate the economy.

It is not the job of the State to talk up markets. The state is focused on what is primary right now – the health of its citizens.

nd the gravest challenge of our time is managing inequality. I would rather have a plan announced in 2 weeks which is thought through and rightly directed, than the one that works just in the interests of stock markets but which ignores how resources will be directed to people at the bottom of the pyramids. Execution will matter more than any grandiose plan.

4. This is not the time to sell

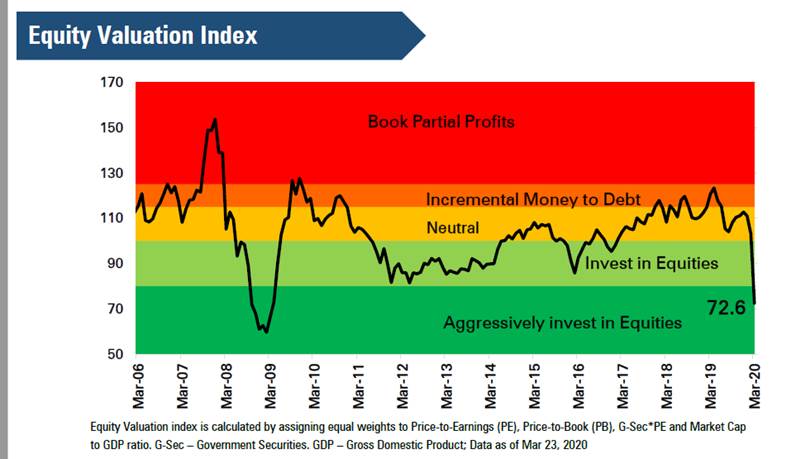

The world is always uncertain – both in terms of shocks and opportunities. What matters is the price you pay for uncertainty. Here is a chart tracked by ICICI MF which shows where valuations are at present.

5. Portfolio actions we will be taking

I have shared with partners that we intend to wait out the storm where we don’t have cash and buy when Capital comes in. We intend to follow through with this. We will not convert paper losses into permanent losses. While I have no visibility on the short term, I have deep conviction – based on lessons from history – that our choice of companies will emerge stronger in a few years. And this will reflect in higher stock prices down the line. A long term investor has to be optimistic about the future. That no matter the adversary, good management teams will find ways to navigate them

And we don’t have to look at financial markets. Even if we look around our immediate family, there will be a history of a traumatic event, which is followed by a recovery and more strength. We will get through this.

What this correction has done however is provided the opportunity to reshuffle portfolios. As we look through the portfolios, what we see is almost a similar move across most Equity positions. This gives us an opportunity to deploy more into better quality names (higher growth longevity, leadership, resilience) compared to others which were relatively lower conviction. You may therefore see some positions moving out of your DEMAT Accounts in the coming week. I wanted to give you a heads up that this is not a change in strategy, but change in our tactical approach.