It has been a really tough month for all of us. Portfolios will be down about ~25-30% in a month. This is a speed of decline which I have never encountered as a Fund Manager.

Solidarity believes that following a disciplined process will result in good outcomes over the medium term, even if we get the occasional bad break that we are experiencing at present. We buy good companies and let them compound only selling when valuations are euphoric or when we believe we have erred in analysis of a company’s prospects. Compounding works best only if it is not interrupted without good reason.

The Corona Virus first surfaced in the mainstream in January but grew in magnitude. We had to take a call as the situation evolved whether

a) This is another unknown variable which causes correction, and this too shall pass

b) This is an event which requires us to question the context with which to view the future – does an economic collapse lies ahead?

Based on China’s experience with Corona (the economy is getting back to work) and the path followed by other epidemics, we felt that the economic disruption would be short term. Hence, we did not sell in the last month to try and protect mark downs. As I shared earlier, all calls have probabilities associated with them.

However, we have been surprised at the pace of selling and mark downs we have experienced. This has primarily been because the developed world politicians did not act with sufficient speed and actions of Govts. since then – while appropriate – have stalled developed world economic activity and created more panic in markets.

There are two scenarios of how the future can unfold in India

Scenario 1 – our base case scenario

- India has done well to contain the crisis so far. The virus may spread further. Cities may come under lock down for a few weeks till the Govt. feel confident that the pace of spread is within control

- Health systems will be swamped and there will be panic

- However, fatality rates will be low as they have been the world over (<2%) other than for the elderly and for those who have pre-existing conditions in the lungs

- There will be short term business disruption and there will be temporary job losses

- Massive stimulus are being announced by Govt’s. in the developed world and the same will be announced in India

- The virus will come under control in a few months. Economic conditions will start picking up in 6 months with normalization in 12 months

Scenario 2- our pessimist scenario

- India witnesses a spike-like what the US is experiencing at present… but without the health Infrastructure to cope

- Lockdowns will continue for long periods of time with complete collapse of economic activity

- The Central Govt. does not act to provide meaningful stimulus

- Poor health conditions are compounded with an employment crisis

- Feedback loops reverberate in the economy leading to a prolonged recession

While Earnings prospects depend on how the above scenario plays out (currently uncertain), valuations already assume the worst or more. The markets are selling off in panic irrespective of price assuming the pessimist scenario is current reality

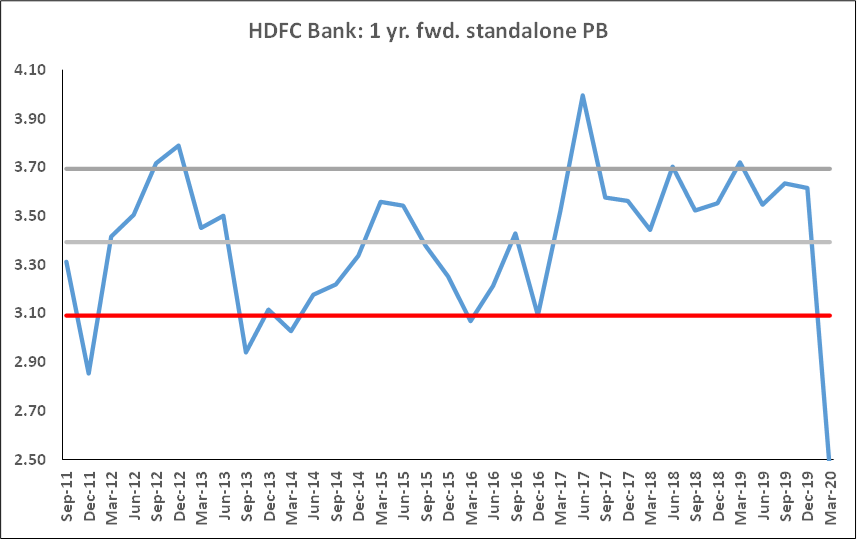

The chart we enclosed on HDFC Bank (India’s most secular growth story till date) is reworked with prices as of close of business today. It is now 2 Std. deviation below mean (if we assume normal earnings trajectory) or perhaps 1 std dev (if we believe FY 21 is a wash-out year for reasons discussed above). The stock seems to be pricing in very poor economic conditions and defaults leading to rising NPAs

The sell-off is undifferentiated/uncorrelated with impact on earnings by sector. As an example, one has to wonder why Utility stocks like NTPC should fall over 20% when their earnings are uncorrelated with the economic environment (it is a regulated ROE model). NTPC now offers a dividend yield close to 6.5% and is is higher than what one would earn on G Secs.

Where do we go from here?

A clearer picture for India will emerge in the next 2/4 weeks – both on the scale of the health challenge we face, and Govt. plan, if any, to provide stimulus.

Long term investing requires us to be willing to lose short term battles to win the war. One cannot think long term and trade short term simultaneously. That approach will never allow compounding to work its magic.

Because stock prices are slaves to earnings, and we have invested in fundamentally strong companies, we believe our portfolios should be materially higher in 3-5 years than where they are at present. We have to be calm and wait out the storm.

We will continue to follow our My North Star: Good process, highest standards of transparency and complete alignment of my family’s interests.