The Corona Virus has given the markets a scare with the benchmark indices ending ~7% lower last week. The large number of cases in Italy has understandably made participants nervous whether this is another normal correction or the start of something deeper and bigger.

I am writing to share with you our perspectives.

Partners are aware that

- We build portfolios with the belief that stock prices are slaves to earnings and with rolling 3-5 year time horizons

- We are solely focused on playing the long game. We will live through corrections if we believe nothing has changed that affects our portfolio companies competitive position or earnings profile in the medium term.

We look at the Corona Virus scare with the same framework – how will it impact our portfolio cos earnings/cash flow in the medium term? Are any actions required?

What do we know

- The Corona Virus has its origins in China but the source of the virus and how it spread into human population still seems unclear.

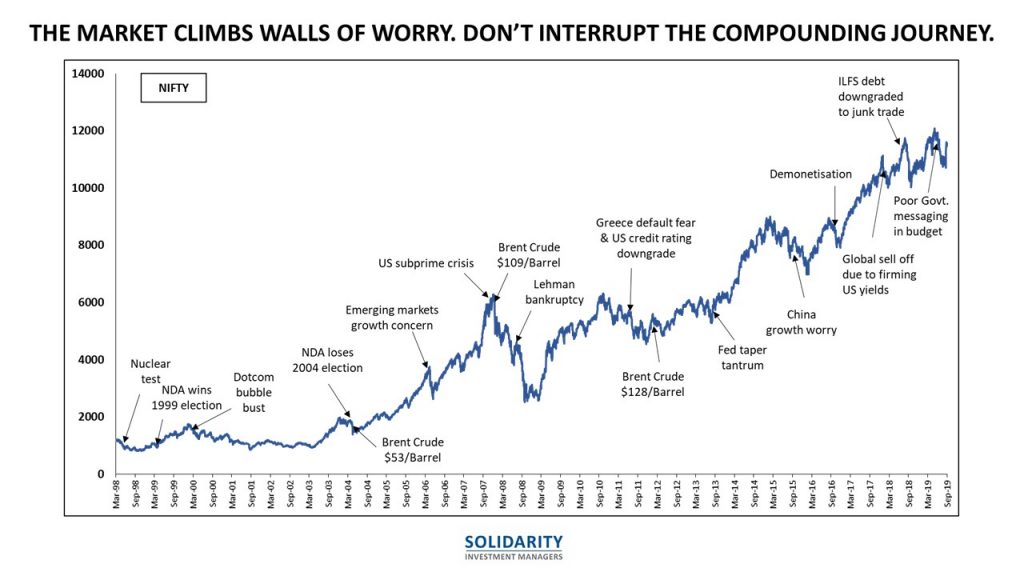

- There have been other such scares in the recent past – SARS, Ebola, Bird Flu etc. At the time they broke out, they caused much anxiety and fears of a new global pandemic. However, like any other market disruptions, these concerns too were overcome over time.

- There is no known cure or vaccine for the virus as yet. However, mortality due to the Corona virus is low and principally in the older population – over 80% of fatalities are in people above the age of 60 suggesting a healthy body has the ability to fight the viru

- China is getting back to work slowly. Even Apple and Starbucks have re-opened their stores. The number of cases in China is declining

What we do not know

- Even as the number of new cases in China is declining, a large number of cases have been detected in Italy. Hence, how large will the problem grow to before it gets contained?

- Will India be resilient to the attack?

- What will be the impact of the virus on medium and long term economic activity?

Putting it all together

- Global economic activity should be affected temporarily due to supply chains being shut down due to shortage of parts and absenteeism of labour. Hence, companies whose supply chains and markets are more dependent on China may see short term earnings pressure in 2020. However, the virus per se, based on what we know so far, should not impact medium term economic activity. China is slowly getting back to work.

- There is no reason to believe that the medium term earnings/cash flow profile of our portfolio companies should be negatively impacted.

- Ironically, the inverse may happen. We have had a very large weightage to the “China +1” theme since 2018 – companies who will gain market share in global supply chains as MNCs look to de risk themselves from China. While this theme was largely premised on other reasons (China crack down on pollution, political risk from trade wars), every new crisis acts as an extra impetus for de risking. Hence, we expect many companies in the portfolio to continue to benefit in the medium term.

- Hence, based on what we know, we see this as another market correction with no actionable implications. As we have shared earlier, markets learn to climb walls of worry. We should not unnecessarily interrupt the compounding journey

The market could sell off further before things get better.

- Partners must appreciate that the future is indeterminate and all calls have probabilities attached to them. The Indian Govt. has acted swiftly to restrict entry of people from infected areas. However, if the pandemic spreads to India, with a large number of cases reported, the market will sell off.

- Even in the absence of the above, players with shorter time horizons may want to sell to stay on the side and re-enter later when more clarity emerges. And they will repeat this cycle when they confront the next uncertainty. This is their game.

Partners can be assured that we will act if we believe events will cause material changes in medium term earnings profile of portfolio companies. However, in the absence of this, we intend to live through corrections.

- Variables that cause market corrections or swift up moves often are unforeseen (for example tax cuts announced in Sep 2019)

- For temporary downside protection, we don’t want to miss a much larger upside.

- We don’t have the skill to exit and time re-entry.

An important question all investors have to confront is the time horizons they operate with. Playing the long and short game simultaneously confuses the mind and, barring a few geniuses, inevitably results in poor results. Being exclusively focused on long term outcomes helps keep the mind calm, think more clearly and increases probability of superior long term Investing outcomes.